Markets Extend Gains for Third Straight Day Amid Easing Tariff Concerns, But Risks Remain

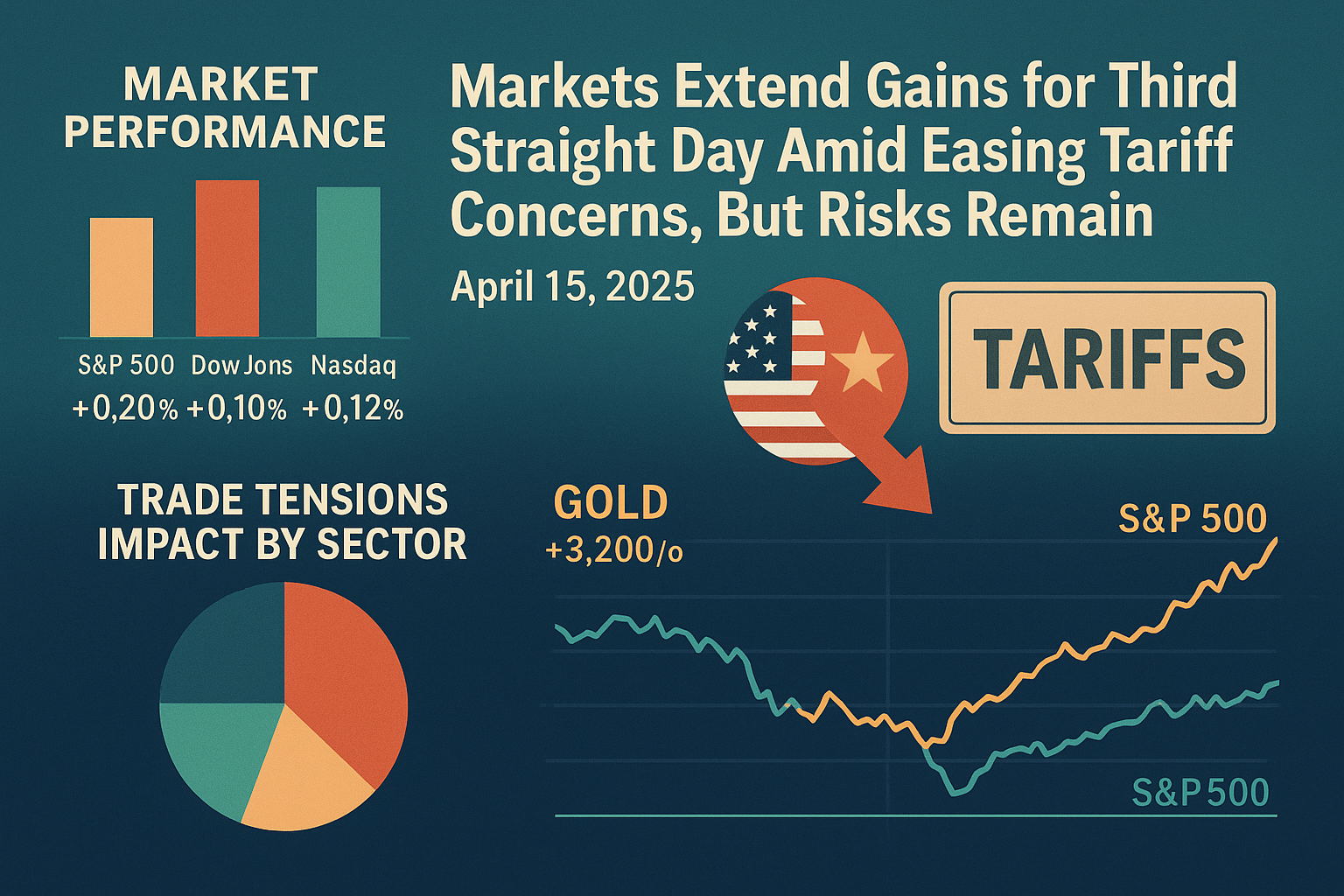

U.S. stock markets opened higher this morning, continuing a three-day recovery streak. The S&P 500 leads with a 0.20% gain, followed by the Dow Jones up 0.10%, and the Nasdaq rising 0.12%.

Markets Extend Gains for Third Straight Day Amid Easing Tariff Concerns, But Risks Remain

This upward momentum follows reports that the Trump administration may temporarily exempt automotive manufacturers from new tariffs, offering them time to move production back to the U.S. However, tariffs on pharmaceuticals and semiconductors are reportedly still on track, creating a mixed outlook for investors.

"Market Performance – April 15, 2025"

(A bar chart showing % increase for S&P 500, Dow, Nasdaq)

Corporate News Highlights:

Boeing shares fell over 3% after China suspended deliveries of Boeing jets, a direct response to U.S.-China trade tensions.

Bank of America and Citigroup gained after strong Q1 earnings and trading revenue beat expectations.

Johnson & Johnson edged higher after raising its forecast, though CFO warned of a $400M profit hit due to existing tariffs.

Albertsons dropped 5%, citing tariff-related supply chain concerns in its weaker guidance.

"Trade Tensions Impact by Sector"

(Pie or segmented chart showing affected sectors: Airlines, Pharma, Tech, Retail)

Airlines (e.g., Boeing) – 35% impact

Pharma – 25%

Tech (Semiconductors) – 20%

Retail (Albertsons) – 20%

Technical Signals Raise Caution:

Despite recent gains, analysts urge caution as the S&P 500 has formed a “death cross”—a technical chart pattern where the 50-day moving average crosses below the 200-day moving average, often a bearish signal.

At the same time, gold continues to rally, now trading above $3,200/oz, reflecting investor interest in safe-haven assets.

The VIX (Volatility Index) has dipped below 30, indicating a temporary drop in fear, but uncertainty remains as earnings season continues and companies reveal their strategies to cope with shifting trade policies.

"Gold vs. S&P 500 (Last 30 Days)"

(A dual-line graph showing gold prices rising while S&P dips and starts recovering)

Sources & References:

Reuters Market Wrap – April 15, 2025

CNBC: Trump Trade Policy Updates

Bloomberg Markets