Personal tax filing for the 2023 tax year is underway in the United States

Meru Sikder, New York: Taxpayers have until April 15th to file their taxes without penalty.

Personal tax filing for the 2023 tax year is underway in the United States

Meru Sikder, New York: Taxpayers have until April 15th to file their taxes without penalty. However, this tax filing season has seen a surge in AI-powered scams, leading to the theft of personal information and money. Experts are urging taxpayers to be extra vigilant to avoid falling victim to these traps.

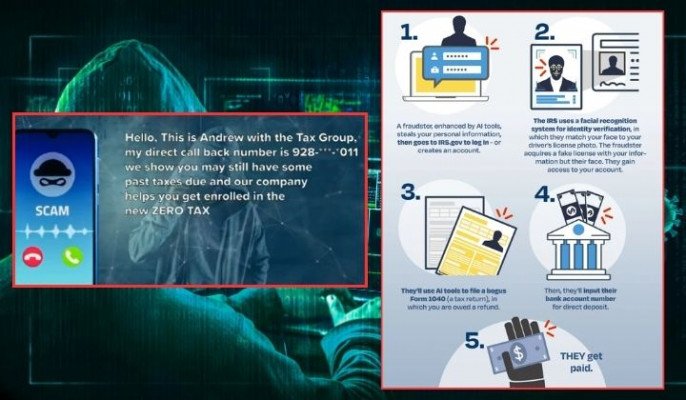

A syndicate is using AI to carry out these scams. They send messages, emails, and voice calls to taxpayers with various offers. If a taxpayer clicks on a link in one of these messages, they can run into trouble. Additionally, scammers sometimes pose as IRS officials to deceive taxpayers. AI is used to create American accents for these calls.

When a taxpayer follows the instructions of these scammers, they are tricked into revealing all of their personal information. If the taxpayer is due a refund, the scammers will then file an application with the IRS using the bank account details of their fraudulent syndicate. The entire refund amount is then transferred to the scammers’ account. In some cases, scammers have also been accused of blackmailing taxpayers using their personal information.

Steve Grobman, Chief Technology Officer at McAfee, says that the dangers of Artificial Intelligence (AI) are becoming increasingly evident. He warns that AI is being used to impersonate people’s voices and call them to ask for personal information. This can lead to the theft of sensitive data.

Grobman also points out that AI voice cloning has reached an all-time high in the past month during tax season. In February alone, McAfee detected over a million URLs that customers tried to click on.

He advises taxpayers to use anti-virus software and call-blocking apps to protect themselves from these scams. These tools can help filter out fake calls. Additionally, taxpayers should be wary of anyone who contacts them and asks for money or a callback, or who sends them a link in a message. The IRS does not make threats and does not contact taxpayers by phone, text, or email.

Grobman also recommends that taxpayers delete or block any gift cards, letters, or links that they receive in emails.